In case of ESOPs, employees might want to exercise the ESOPs so that the shares hit their demat and they can eventually sell them, say when there is an IPO in the future

A client of ours rushed to us that he had got a hefty tax bill from his Accounts/Taxation team on exercising the ESOPs and since the sale had not yet happened, he simply did not have the money to foot the tax

So, a major liquidity crunch comes when they have to pay tax on exercising the ESOPs without actually getting the cash on sale 🙁

This is at the Leg 1 stage of the ESOP taxation cycle

Leg 1

The first leg of taxation under the head “Income from Salaries” u/s 17(2) of Income Tac Act is when the employee exercises the ESOPs to buy the shares. The difference between the Fair Market Value (FMV) of the shares on the exercise date and the exercise price is treated as a perquisite and is taxed accordingly.

Leg 2

The second leg of taxation under the head “Capital Gains” is when the employee decides to sell the shares acquired through the ESOPs. It is the difference between the sale price and the FMV of the shares on the exercise date

Of course, one would want to exercise the option at a given date and optimise taxes on the gain between that date and the sale. e.g. you exercise shares at Rs 5/- per share when FMV is Rs 50/- . This gap gets taxed Income from Salaries in Leg 1.

But appreciation from Rs 50/- to Rs 200/- on actual sale gets taxed at 20% with indexation as a Long Term Capital Gain – So the Leg 2 is actually more tax efficient

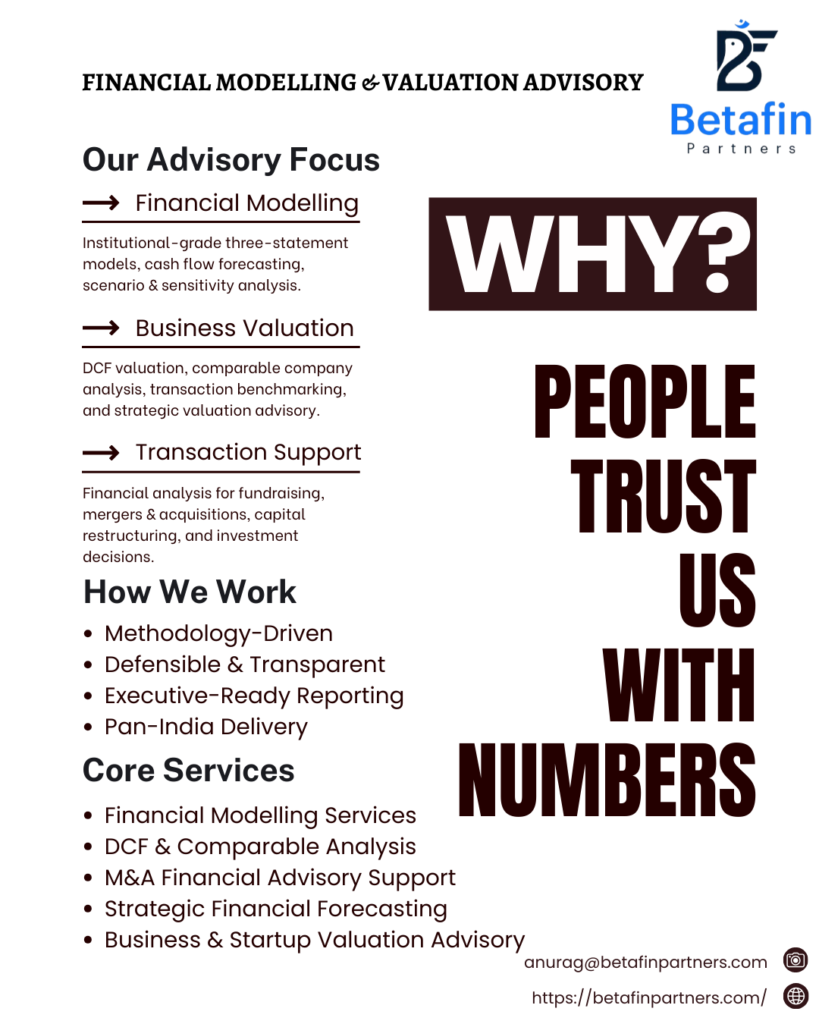

Is there any way of optimising the first leg of the taxation- from a liquidity perspective ? In some of our clients at BetaFin Partners , the company buys back the ESOPs, cancels the same – and the amount paid is taxable under the head Salaries

(Union Budget 20202- employees of ‘eligible’ startups were given an option to defer their tax on ESOPs by five years from the date of exercise or at the time of departing the company or at the time of sale of those shares whichever happens earlier. The eligible startups are determined by a body called the Inter-Ministerial Board set up under the department for the promotion of industry and internal trade (DPIIT).

But not everyone is a DPIIT. As on 31.12.2023, out of 1,17,254 startups, only 2,975 startups were given this beenfit

Will having an ESOP Trust help in deferring the incidence of taxation? Yes, it does

For Employees: If an ESOP structure requires the trust to hold the shares for and on behalf of the employees upon exercise. The exercise happens when the valuation is still less at a lesser perquisite tax. Then, the delta of value growth up to liquidity event/ IPO is generally taxed as capital gains at a lower rate.

For the Trust:The trustees of the ESOP trust are not personally responsible for any tax liabilities. The tax implications for the trust typically involve capital gains taxes.

For the Company: The tax is to be handled by the trust and the employees involved. The company hs no tax liability from trust transactions particularly when the trust is irrevocable.

So, this was a analysis of the current law of the land w.r.t. ESOP Taxation