In the world of mergers and acquisitions (M&A), understanding the financial nuances of a transaction is crucial. One such key aspect is Purchase Price Allocation (PPA). This process helps determine how the purchase price paid for a business is allocated across its assets and liabilities. PPA is not just a technical accounting requirement—it plays a vital role in financial reporting, tax considerations, and strategic decision-making.

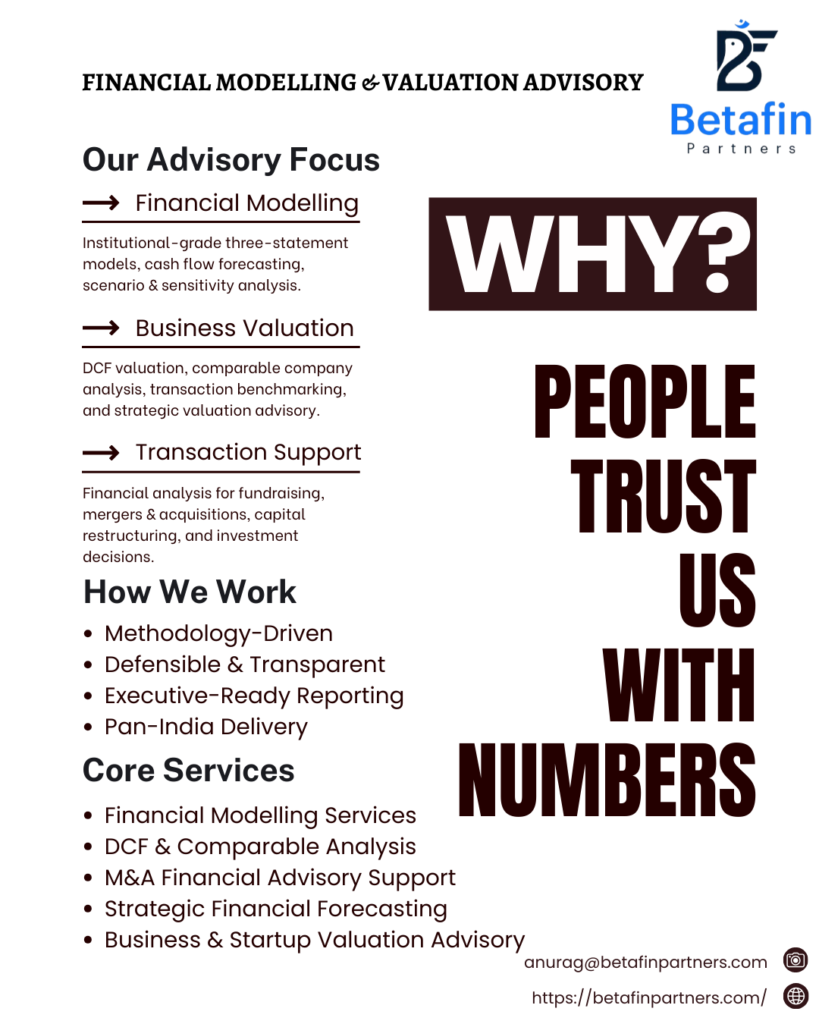

At Betafin Partners, as experts in finance and strategy consulting, we’ve observed that a well-executed PPA can make a significant difference in how a business is valued post-acquisition. Let’s dive into the fundamentals and importance of Purchase Price Allocation.

What is Purchase Price Allocation?

When one company acquires another, the total purchase price paid needs to be allocated among the acquired assets and liabilities. This allocation is based on the fair market value of identifiable tangible and intangible assets, liabilities, and any residual consideration which may lead to the creation of goodwill.

PPA is a requirement under accounting standards such as IFRS 3 (International Financial Reporting Standards) and ASC 805 (Accounting Standards Codification) for business combinations. These rules ensure that post-acquisition, the financial statements accurately reflect the value of what was acquired.

The Key Steps Involved in PPA

1. Determine the Purchase Price

The first step is determining the total purchase price, which includes not only the cash paid but also contingent payments, assumed liabilities, stock issued, or other financial instruments exchanged as part of the deal.

2. Identify and Measure Assets and Liabilities

The next step is identifying and valuing all acquired tangible and intangible assets, as well as liabilities. Tangible assets include property, equipment, and inventory, while intangible assets might include patents, customer relationships, trademarks, and more.

3. Valuing Goodwill

After allocating the purchase price to all identifiable assets and liabilities, any excess of the purchase price over the fair value of net assets is recorded as goodwill. Goodwill represents the premium paid for expected future benefits from the acquisition, such as synergies, market share, or other strategic advantages.

4. Amortization and Impairment Testing

Certain intangible assets are amortized over their useful life, while goodwill is not amortized but subject to annual impairment tests to ensure it retains its value on the balance sheet.

Why is PPA Important?

1. Impact on Financial Statements

The way purchase price is allocated can have a significant impact on the company’s balance sheet and income statement. Understated intangible assets may inflate goodwill, while overstated assets may lead to excessive amortization, reducing profits in future years.

2. Tax Implications

PPA can have tax implications for both the buyer and seller. For example, the allocation to tangible and intangible assets may impact depreciation and amortization, which in turn affects the company’s tax liabilities.

3. Transparency and Investor Confidence

A well-documented and accurate PPA process helps in ensuring transparency and improving investor confidence. It provides clarity about the true value of the acquired assets and goodwill, giving investors and stakeholders a clearer picture of post-acquisition performance.

Common Challenges in PPA

– Valuing Intangibles: Identifying and valuing intangible assets such as brand names, technology, or customer relationships can be subjective and complex. This often requires expert appraisals and sophisticated valuation methodologies.

– Impairment of Goodwill: While goodwill is not amortized, it must be tested for impairment annually. Significant impairments can negatively affect earnings and create uncertainty in the market.

– Changing Accounting Standards: As global accounting standards evolve, the methods and rules around PPA may also change. Keeping up with these changes is critical for accurate financial reporting.

Conclusion

Purchase Price Allocation is a vital part of the M&A process, ensuring that the financials of an acquisition reflect the true value of the acquired assets and liabilities. At Betafin Partners, we help businesses navigate these complex waters, providing strategic insights and technical expertise to maximize value in any transaction. A robust PPA strategy not only ensures compliance but also lays the foundation for long-term financial health and investor confidence.

For further insights on PPA or to explore how we can assist your business in M&A, strategy, or finance, feel free to contact us at Betafin Partners.