BetaFin Partners recently worked on the buy-side Financial Due Diligence in a recent deal in the education space – deal value undisclosed in the public domain

If we conduct the Financial Due Diligence diligently, it is amazing how much value we can add to the client

Consequent to our findings dossier, the adjustment to deal value ( to be kept in abeyance till the outcomes were decided by external events e.g. order by ITAT) were impactful. They were > 2% of the deal and 150X our fee

Normally if you look at the FDD for M&A landscape, it is dominated by the Big 6 – normally investors want the brand assurance , but boutique firms have their own space under the sun

If you can give a client 150X multiplier on your fee, it is absolutely fulfiling and repeat business comes relatively easier

hashtag#duediligence hashtag#M&A

share

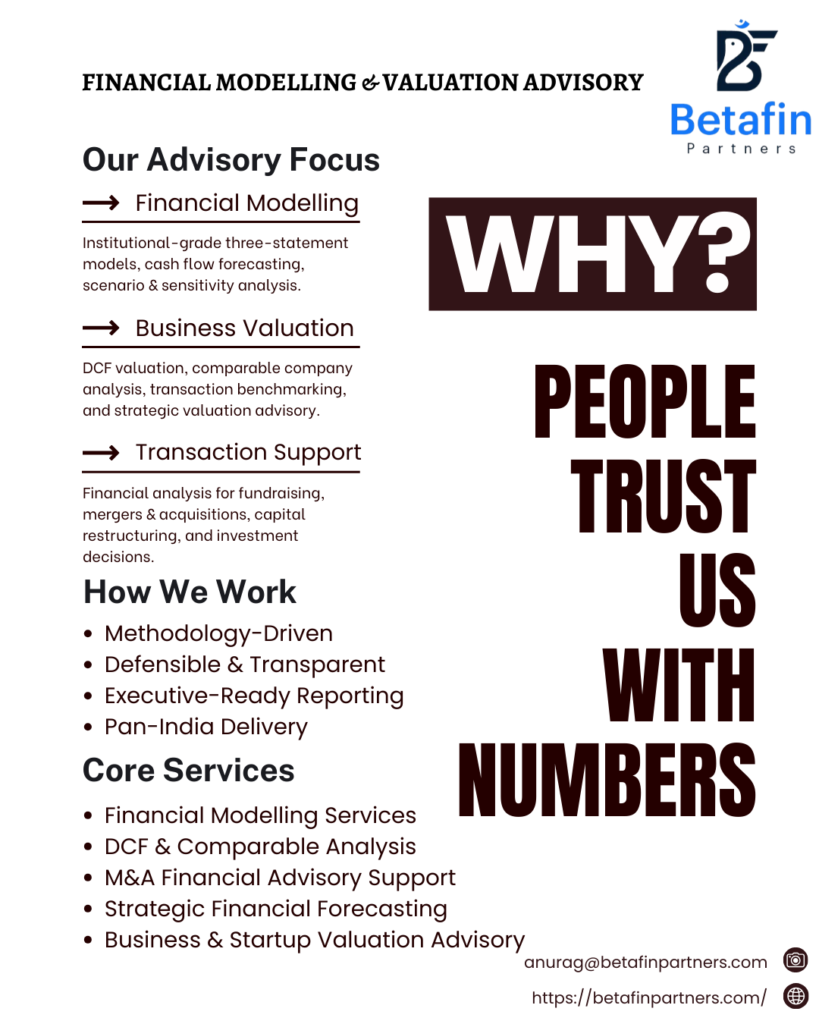

Why People Trust Us With Numbers?